Artificial Intelligence (AI) is no longer a futuristic concept. It’s already reshaping industries, and the financial sector is one of the biggest beneficiaries. From AI-powered banking apps to financial AI solutions that prevent fraud and automate risk management, AI is making financial services faster, safer, and more personalized.

Whether you run a bank, a fintech startup, or manage investments, understanding how AI in financial services works is essential to stay competitive. In this guide, we’ll explore its uses, benefits, tools, and future trends in a clear, simple way.

What is AI in Financial Services?

AI in financial services refers to using technologies like machine learning, natural language processing, and automation to improve tasks such as:

- Customer service

- Fraud detection

- Credit scoring

- Risk management

- Investment recommendations

- Regulatory compliance

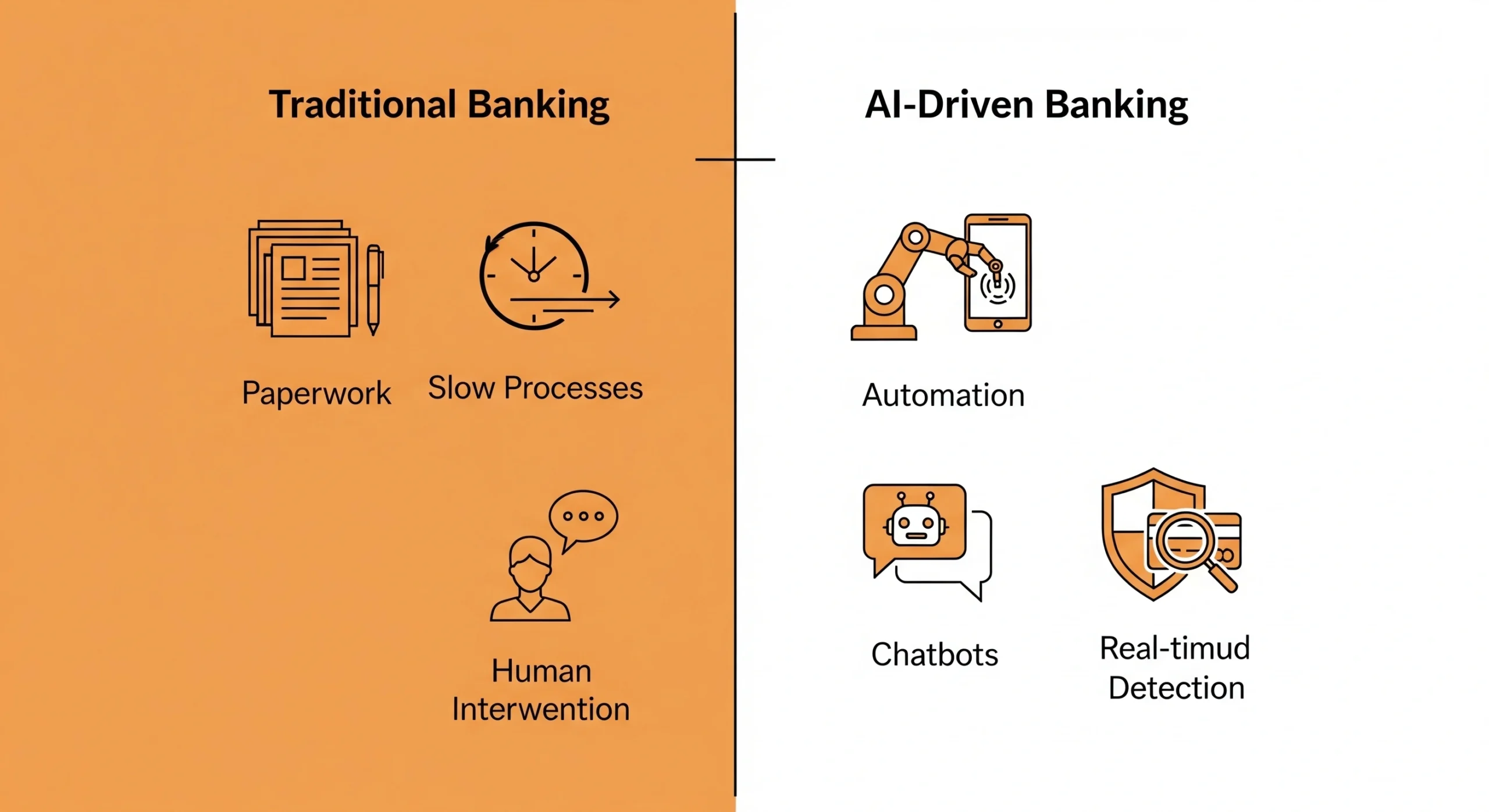

Traditional financial systems rely heavily on human input and outdated processes. AI-powered systems automate these processes, analyze huge amounts of data in real time, and make accurate decisions without errors.

Businesses are investing in AI development services to automate processes and improve decision-making.

Why AI is a Game-Changer for Banking and FinTech

AI is revolutionizing the way banks and fintech companies operate. Here’s why it matters:

| Traditional Financial Services | AI-Driven Financial Services |

| Manual processes → slower operations | Automated workflows → faster processing |

| High human error rates | Machine learning reduces errors |

| Reactive fraud detection | Real-time fraud detection and prevention |

| Generic customer support | Personalized, 24/7 virtual assistants |

| Limited data insights | Predictive analytics for better decisions |

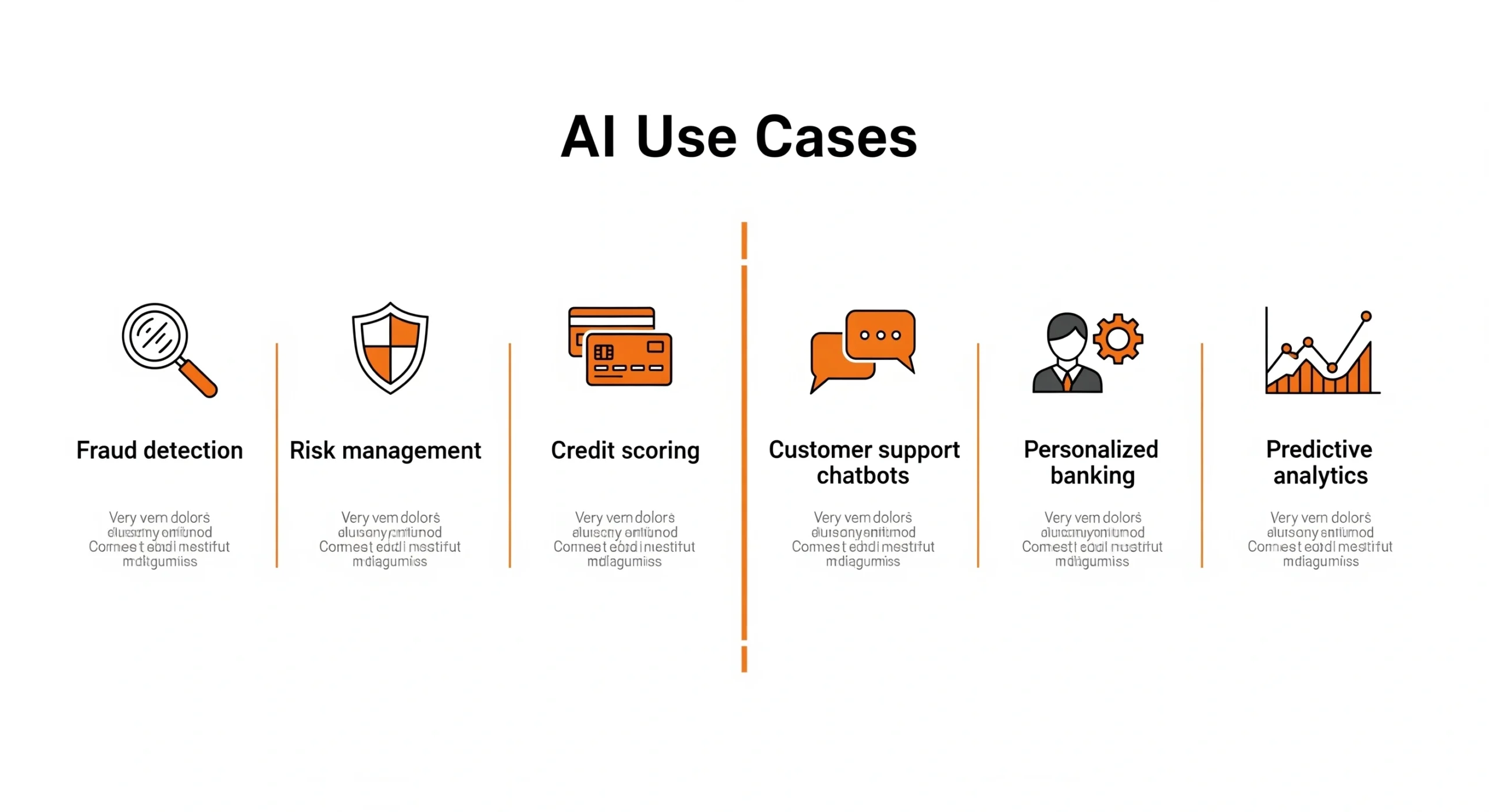

Key Use Cases of AI in Financial Services

1. AI in Banking: Personalized Customer Experiences

Banks are using AI to create smarter, more personalized customer journeys.

- Chatbots and Virtual Assistants: Tools like ChatGPT-based bots help answer questions instantly.

- Personalized Offers: AI analyzes customer behavior to recommend tailored services.

- Voice Banking: VEO-optimized AI allows users to check balances or transfer money through voice commands.

Example:

Bank of America’s Erica chatbot helps millions of users with account management and financial advice.

2. Fraud Detection and Security

Fraud costs financial institutions billions every year.

AI systems detect suspicious activity in real time, flagging unusual patterns before fraud occurs.

- Transaction monitoring with ML algorithms

- Biometric verification (face, voice, fingerprint recognition)

- Predictive fraud prevention models

Example:

Mastercard uses AI to monitor 75 billion transactions annually, detecting fraud with high accuracy.

3. AI for FinTech Growth

FinTech startups are leveraging AI to disrupt traditional banking.

- Robo-Advisors: Provide automated, low-cost investment advice.

- AI Credit Scoring: Assess customer creditworthiness using alternative data like spending habits.

- RegTech Solutions: AI simplifies compliance with changing regulations.

Example:

FinTech giant PayPal uses AI for real-time fraud detection and to recommend personalized product features.

4. Predictive Analytics for Risk Management

AI models predict potential risks, helping companies make smarter decisions.

- Portfolio risk assessment

- Predicting loan defaults

- Stress testing financial systems

This allows organizations to prepare for market volatility and avoid financial losses.

5. Back-Office Automation

AI handles repetitive back-office tasks like:

- Document verification

- Account reconciliation

- Regulatory reporting

This frees up employees to focus on higher-value work while reducing operational costs.

Top Financial AI Solutions

Here are some tools and platforms that enable AI in financial services:

| Tool / Platform | Purpose |

| IBM Watson | Customer service automation and predictive analytics |

| Kensho Technologies | Market intelligence and data analytics |

| DataRobot | AI model building for risk prediction |

| Darktrace | Fraud and cyber threat detection |

| Ayasdi | Compliance and regulatory automation |

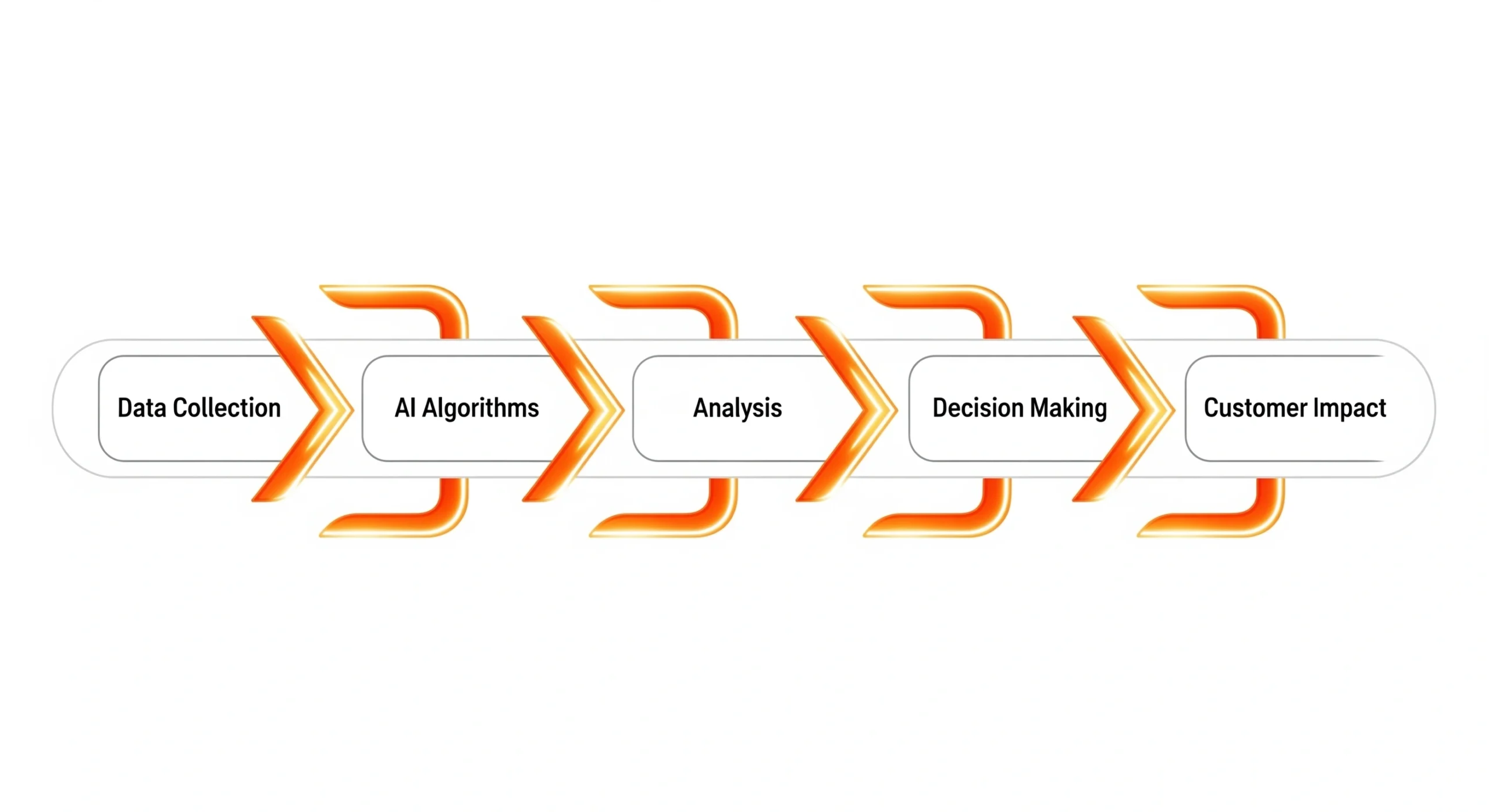

How to Implement AI in Financial Services – Step-by-Step

- Identify Needs

Start by analyzing where AI can bring the most value, like fraud detection or customer service. - Collect and Clean Data

AI relies on high-quality data. Clean and organize customer and transaction data. - Choose the Right Tools

Select financial AI solutions based on your goals. - Integrate with Existing Systems

Ensure smooth communication between AI tools and your current software. - Train and Monitor

Continuously train AI models with fresh data and monitor performance to prevent bias. - Stay Compliant

Follow regulations like GDPR or PCI DSS when handling sensitive data.

The Role of LLMs like ChatGPT, Gemini, Claude, and Perplexity

Large Language Models (LLMs) are shaping the future of customer engagement in finance:

- ChatGPT & Claude: Create natural, human-like interactions for chatbots.

- Gemini: Powers advanced multi-modal insights, combining text, voice, and images.

- Perplexity: Enhances financial research and knowledge management for advisors.

These tools also help financial institutions create AI-powered content, automate compliance reports, and improve decision-making.

Future Trends of AI in Financial Services

The future of AI in banking and fintech looks promising:

- Hyper-personalization: Customized services based on individual financial behavior.

- Explainable AI (XAI): Transparency in AI decisions for compliance.

- Quantum AI: Ultra-fast financial modeling.

- Voice-first banking: Growth in voice-enabled financial interactions.

- Sustainable AI: Eco-friendly algorithms to reduce energy consumption

FAQ’s

What are the main benefits of AI in financial services?

AI improves efficiency, reduces fraud, offers personalized customer experiences, and lowers operational costs.

How is AI used in banking?

AI is used for virtual assistants, fraud detection, predictive analytics, and creating customized banking services.

Which AI tools are best for financial institutions?

Popular tools include IBM Watson, Darktrace, DataRobot, and Kensho.

Conclusion: The AI-Powered Financial Future

AI is no longer optional for banks and fintech companies. It’s the key to delivering faster services, improving security, and staying competitive in a rapidly evolving digital landscape.

By adopting the right financial AI solutions and embracing tools like ChatGPT, Gemini, and Claude, businesses can transform their operations and build trust with customers.

Ready to integrate AI into your financial services?

Contact VirtueNetz to discover customized solutions that can take your business to the next level.

?>

?>

?>

?>

?>

?>

?>

?>

?>

?>